In the dynamic landscape of engineering services and digital transformation, Tata Technologies emerges as a key player poised to make a significant impact. As industries worldwide seek innovative solutions, Tata Technologies offers a spectrum of services, making it a vital ally for global manufacturing clients.

Imagine you’re an electric vehicle (EV) company facing challenges in battery hardware or aiming to upgrade your scooter’s digital dashboard. Enter Tata Technologies, a global leader providing outsourced engineering and digital transformation services. With a diverse workforce exceeding 12,000, spanning three continents, Tata Technologies delivers end-to-end solutions across industries such as automotive, aerospace, transportation, construction, and heavy machinery (TCHM).

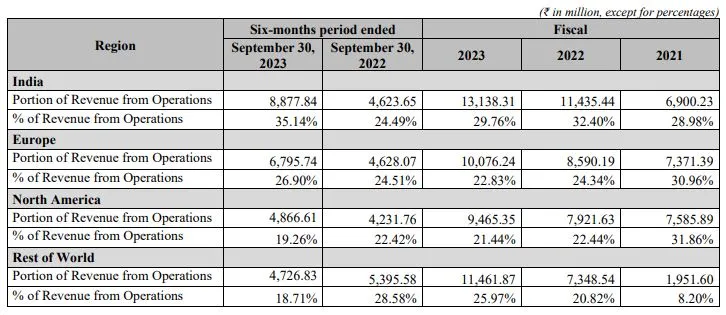

1. Services Segment: contributing 80% and 78.62% to the total revenue in Fiscal 2023 and the six months ending Sep 30, 2023, respectively, involves outsourced engineering, designing, and digital transformation servicesents.

2. Technology Solutions: constituting 20% and 21.38% of the respective periods, encompasses products and education businesses

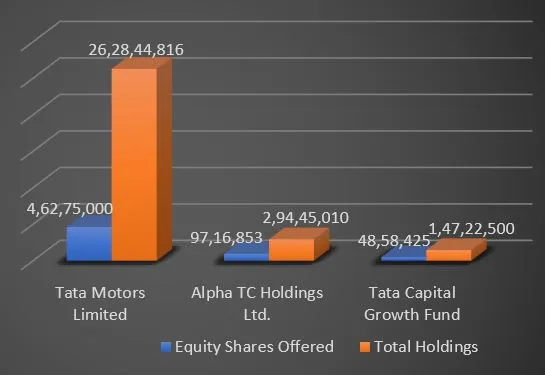

Tata Technologies embarks on its IPO journey, offering up to 60,850,278 equity shares with a face value of Rs.2 each. The IPO, entirely an Offer for Sale (OFS), is set to go live on November 22, 2023, and will be open for subscription until November 24, 2023. The price band per share is fixed at Rs 475 to Rs 500, with each lot comprising 30 shares. All proceeds from the will go to the selling shareholders, including the promoter Tata Motors Limited, and investors Alpha TC Holdings Pvt. Ltd. and Tata Capital Growth Fund I.

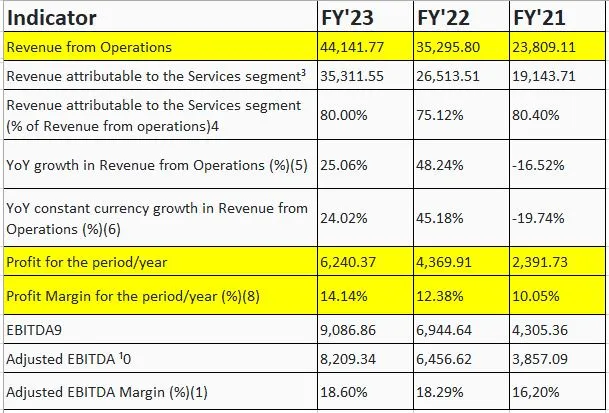

1. Financials and Key Performance Indicators.

2. Demographics of the business.

3. Clientele and Peer Review

A glance at Tata Technologies’ financials reveals impressive figures. With a Compound Revenue Growth Rate of 36.23% for FY’21-FY’23 and a Net Profit CAGR of 61.53% during the same period, the company demonstrates robust operational efficiency. The overall profit margin has also increased from 10.05% in FY’21 to 14.14% in FY’23.

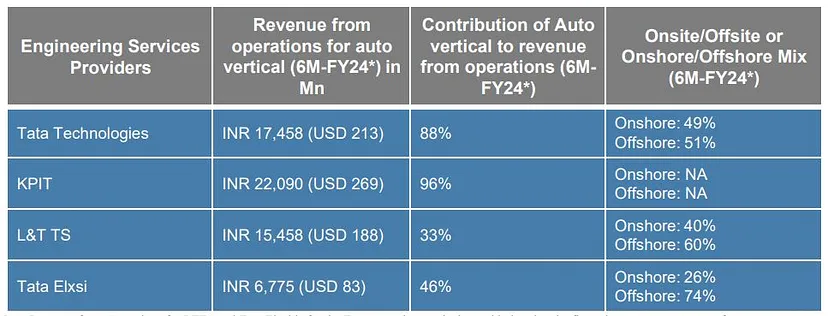

While the company envisions acquiring new clients, it acknowledges a substantial reliance on its promoter, Tata Motors, and its subsidiaries, including Jaguar Land Rover Automotive PLC, UK. Diversification efforts are underway, but the prominence of the automotive segment in the clientele poses a potential vulnerability.

Talking about the peer review for TATATECH, the company has competition with three giants listed on the stock exchange. Below table gives a quick glimpse of the the market penetration for the first two quarters of FY 2023–24.

Surprised to see another TATA subsidiary in the list! Well, TATA conglomerate is a huge empire. However, the RHP has mentioned that the the extent of overlap from the TATA group companies such as TCS and Tata Elxsi is limited.

In conclusion, Tata Technologies’ upcoming IPO showcases a company with strong fundamentals, a stellar financial track record, and the formidable backing of the Tata name. The awareness of potential downsides and active efforts to limit vulnerabilities position Tata Technologies as a promising prospect. As investors consider their options, the complete RHP provides detailed insights into the company’s trajectory.

Leave A Comment